About DFIs

Experts' insights

The needs and perils of investing in fragile and conflict-affected situations

This essay is part of a collection of essays that build on key themes related to impact and DFIs. These essays are intended to supplement, and to engage in dialogue with, the discussions at EDFI’s annual Impact Conference 2022, and to address the same overarching topics. FMO commissioned TrustWorks Global and NIRAS global development consulting to undertake a study on the conditions for successful investments in FCS . In this article, Christiaan Broekman - Evaluation Officer in the Strategy department at FMO, who coordinated the study – gives an outline of the findings of this independent study.

As stated in the introduction of the report, ‘fragile and conflict-affected situations (FCS) are not only the world’s toughest markets: they are the most challenging places to live and thrive. These are countries where access to basic services – education, health, infrastructure – is minimal and worsened by the absence of security and rule of law. These dynamics have immediate effects not only on lives and livelihoods, they affect generations to come.” [2] The World Bank expects around 80 per cent of the global extreme poor to be living in FCS by 2030[3] and yet these same populations are reliant on a pool of overseas development assistance (ODA) that has been decreasing. There is a key role for DFIs in relieving the funding shortfall and stimulating the levels of economic growth and job creation required to transition out of fragility.[4] To ensure that development financial institutions (DFIs) do not exacerbate the very dynamics that drive inequality and fragility, the study underscores that such investment must be responsible, inclusive and conflict-sensitive.[5]

What are FCS and how should investments there be approached?

While there is no widely agreed-upon definition of “fragility”, actors within the international community generally see fragility as a continuum, understood as “the degree to which state power is unable and/or unwilling to deliver core functions to the majority of its people: security, protection of property, basic public services, and essential infrastructure” (Amorós et al, 2019 as cited in Kaye, 2021).

As outlined in the World Bank classification[6], fragile contexts can be understood as those that are conflict-affected (e.g., Afghanistan, Somalia) or reflected in institutional and/or social fragility (e.g., Lebanon, Zimbabwe). The study suggests that what characterises all FCS is the unique nature of their internal dynamics, with makes both defining – and investing in – FCS a particular challenge.

As underscored in the study, greater attention to fragility and conflict does not imply a departure from the mandate of DFIs, but instead acknowledges that development can have a direct link to stability and peace.[7] For example, there is some evidence that a lack of employment opportunities for youth poses a particular risk for increased fragility (Datzberger, 2013).

More strategic approaches can focus on steering market development, fostering working conditions improvement, and spurring economic growth while addressing conflict fault-lines and societal divisions. Doing so requires that DFIs understand and actively manage political, economic, societal and environmental dynamics when selecting countries, investees and partners.

Indeed, regardless of specific nature of fragility, extensive policy frameworks regarding international aid in situations of fragility suggest that there are practical steps that DFIs can take to ensure that their activities at a minimum do not ‘cause harm’, and where possible that they actively work on the drivers of fragility with a view to contributing to peace and stability.[8]

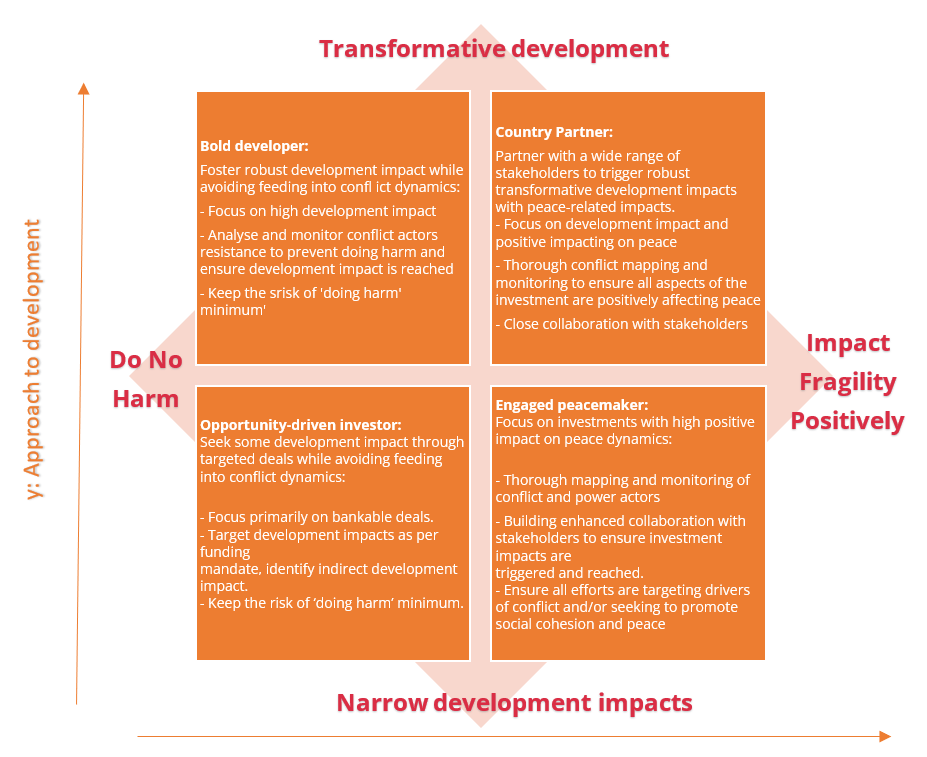

Investing in FCS in an impactful way requires a transformative approach.[9] As presented in the model developed by TrustWorks, DFIs may choose different strategic directions when it comes to their approach in FCS, along two dimensions (see graph below): i) their approach to conflict, which can range from a minimal ‘do no harm’ approach to one of positively impacting fragility and conflict, and ii) their approach to development, which can range from seeking narrow development impact to transformative development impact.[10]

Once the strategic directions have been decided, there are other practical steps that DFIs need to take that emerged from the study. TrustWorks refers to these as “minimum standards for investing in FCS”, which apply regardless of the specific approach decided by the DFI in question.

First, clarify the strategic approach. [11]

Prior to making an investment in FCS, DFIs should have a clear strategic position on their investment; they should clarify the rationale and implication for investing in a particular context, including “internal clarity on what drives investments, the linkages with incentive structures, implications for monitoring and how the strategic position will be communicated effectively internally and externally.”[12]

| Figure 1: Potential approaches to conflict and development taken from Kaye et al. (2021) pages 14 and 57. | |

Second, commit to conflict sensitivity analysis and strategies.

No matter the strategic profile, it is essential that DFIs approach investments in FCS with a commitment to conflict-sensitivity analysis and strategies.[13] At the moment, “DFI assessments of a country’s context tend to be state-centric, focussing on ‘formal’ rather than ‘informal’ actors and dynamics.”[14] FCS are often characterized “not by a lack of governance, but instead by competing sources of governance”[15] – informal institutions, unique ‘rules of the game’, etc.; as such, state-centric assessments risk underestimating the informal complexities (and unpredictability) of operating in FCS, with consequences for both project success and the relevant conflict.

Indeed, without combining country-level analyses of the context with considerations of the specific circumstances of the client (e.g. the sector, the supply chain, operations, staff), it can be difficult to assess what kind of impact the investment will have on drivers of conflict.”[16] It becomes crucial in such contexts, therefore, to elaborate a country-based conflict-sensitivity process that accurately understands and accounts for the interaction effects – or potential interaction effects – between the investment and the context.

Third, tailor investment modalities, including partnerships, financial instruments and technical assistance.

Partnerships are critical to the success of investments in FCS. Room for improvement is noted in particular with regards to inter-DFI cooperation, as well as with other key strategic actors across the humanitarian-development-peace nexus.[17] Rather than competing, “DFIs should be working together based on their comparative advantages” (for example, knowledge and expertise of particular countries or sectors).[18] A comparative advantage-based formulation of strategies would not only help maximise development impacts but also help share risk.[19]

Such considerations extend also to the financial instruments that DFIs are able to leverage: the report finds that, even though lending still represents the most common instrument used by DFIs in FCS, there could be other financial instruments that prove to be even more effective (e.g., development impact bonds, equity or blended finance[20]), if institutions are in a position to offer these.

Depending on the strategic profile selected in the TrustWorks model, a DFI may also deliver Technical Assistance at the sector- or country-level, rather than the client-level, based on a context-specific assessment of need.[21]

Given the wide variety of skill-sets required of DFI employees working in FCS – including political economy analysis, conflict sensitivity and risk-management, and the need for extensive data collection – there are clear benefits to working together, identifying institutional strengths, and pooling expertise.[22]

In conclusion

While FCS have long been defined as “risky” places to invest in, there are diverse opportunities for DFIs to broaden their impact towards peace and stability objectives without steering away from their core expertise. Indeed, with the right approach, they can contribute not only to economic development, but also to stability and peace.[23]

For the full report, please visit FMO’s website: Investing in Fragile and Conflict-Affected States – FMO

………………………………………….

Sources

This article is based on: Kaye, Josie Lianna (lead author), with Jihed Hannachi and Marc Jacquand, ‘Conditions for successful investments in fragile states’, A TrustWorks-led project in partnership with NIRAS for the Dutch Entrepreneurial Development Bank (FMO), Geneva, Switzerland, November 2021

Amorós, J E, Ciravegna, L, Mandakovic, V, Stenholm, P, 2019 ‘Necessity or opportunity? The effects of state fragility and economic development on entrepreneurial efforts’, Entrepreneurship Theory and Practice, Vol. 43, No. 4, pp. 725-750

Datzberger, S, Denison, M, 2013 ‘Private Sector Development in Fragile States’, ESP PEAKS, September 2013

[1] Kaye, Josie Lianna (lead author), with Jihed Hannachi and Marc Jacquand, ‘Conditions for successful investments in fragile states’, A TrustWorks-led project in partnership with NIRAS for the Dutch Entrepreneurial Development Bank (FMO), November 2021

[2] Ibid, page 16.

[3] https://www.worldbank.org/en/topic/poverty/publication/fragility-conflict-on-the-front-lines-fight-against-poverty

[4] Kaye et al/ (2021), page 21.

[5] Ibid, page 16, 22, 24, 32.

[6] https://thedocs.worldbank.org/en/doc/333071582771136385-0090022020/original/ClassificationofFragileandConflictAffectedSituations.pdf

[7] Kaye et al/ (2021), page 49.

[8] Ibid.

[9] Ibid.

[10] Ibid.

[11] One of three minimum standards, cited in Kaye (TrustWorks, 2021).

[12] Ibid.

[13] Ibid.

[14] Ibid, page 10, 24.

[15] Ibid, page 25.

[16] Ibid.

[17] Ibid, page 33.

[18] Ibid.

[19] Ibid.

[20] Ibid, page 54.

[21] Ibid, page 54.

[22] Ibid,, page 55.

[23] Ibid,, page 47.

About the author:

Christiaan Broekman is an Evaluation Officer in the Strategy department at FMO. He coordinated the externally commissioned study on Investing in Fragile States, which this essay largely relies on.

The published essay represent the views of the authors alone, and do not reflect the opinions of either the EDFI Association or its member institutions.